The New Oil: Green Hydrogen From the Arabian Gulf

In the early years of the 21st century, hydrogen enjoyed great industrial attention, from car-makers to developers of fuel cells, electrolyzers and storage systems, expecting a rapid market breakthrough. So far, the market uptake of hydrogen has hardly lived up to the promise, leaving many supporters and financiers disappointed, particularly with regard to transportation. In the short-term, battery electric vehicles seem to have gained the upper hand, at least for the private vehicle sector. What has changed and why should we be excited about hydrogen now? Let’s look at the GCC.

Hydrogen in the GCC

The 6 national economies of the Gulf Cooperation Council (GCC) – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE) – have emerged largely on the back of oil & gas exports. But the availability of hydrocarbons has also led to heavy industry including steel-making, aluminium smelters, refineries and chemical industry. Many of those industries have been producing and using hydrogen at large-scale for decades, mainly for producing fertilizers, in refineries and to a lesser extent in the chemical industry. In the long-run, all industries need to decarbonize and there is a potential pathway for that, involving hydrogen made using renewable energy. This hydrogen has the potential to substitute oil and gas in the electricity and transport sector domestically, as well as for export.

Grey, Blue and Green

Some hydrogen is produced as a by-product in refineries and can be re-used after treatment, such as to reduce the sulfur content in transport fuels. Most hydrogen, however, is produced through steam methane reforming, and the resulting hydrogen is characterized as “grey hydrogen”, due to its fossil origin and association with CO2 emissions. Steam conversion of one ton of methane releases about four tons of CO2 into the atmosphere. If the production of hydrogen is less carbon-intensive, for example if the CO2 is captured and permanently stored underground through carbon capture and storage (CCS), the hydrogen is called “blue hydrogen”, a term introduced by Air Liquide, one of the largest hydrogen producers. If the hydrogen is produced from water using carbon-free renewable energy such as wind or solar electricity in an electrolyser, the hydrogen is called “green hydrogen”. All hydrogen produced in the GCC is currently grey.

Green Hydrogen in the GCC

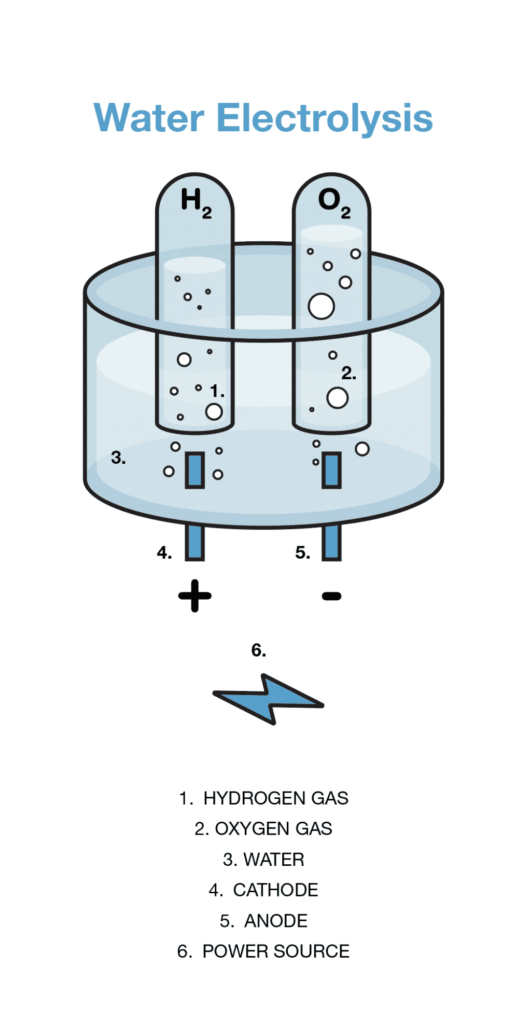

The process to make hydrogen from electricity, referred to as power-to-gas, is a relatively straightforward process involving an electrolyser, which splits water (H20) into its two components hydrogen (H2) and oxygen (O2). Due to the scarcity of fresh water in the Arabian Gulf, the water will be sea water, which first needs to be desalinated using a process called reverse osmosis (RO).

Solar Energy in the Gulf

The Middle East has presented several world-record-breaking solar energy plants in Dubai, Abu Dhabi and Saudi Arabia. The GCC has the lowest cost solar electricity in the world. The Maktoum Solar Park in Dubai will house the DEWA III 800MW solar PV plant, which will produce electricity at 2.99 $ct/kWh, immediately followed by the 1.2GW Sweihan solar PV project in Abu Dhabi, which will produce electricity at 2.42 $ct/kWh. The 300MW Sakaka project in Saudi Arabia was even cheaper at 2.34 $ct/kWh. The lowest bid for the Sakaka came in at 1.79 $ct/kWh but was reportedly disqualified for proposing to use less proven bifacial solar modules. Nonetheless, this shows that even lower prices are possible. Given solar PV’s continuous and spectacular price reduction over the last years, future solar PV projects can generate daytime solar electricity at 1.5 $ct/kWh.

| The cheapest solar power in the world | ||

| DEWA III 800MW Maktoum Solar Park | Dubai |

2.99 $ct/kWh |

| 1.2GW Sweihan solar PV project | Abu Dhabi |

2.42 $ct/kWh |

| 300MW Sakaka | Saudi Arabia |

2.34 $ct/kWh |

To complement daytime solar PV, concentrated solar power (CSP) with integrated thermal storage can be used to produce nighttime solar electricity. The DEWA IV CSP project in Dubai is a 700MW combination of a central tower and 3 identical parabolic trough plants with 15 hours of daily storage, producing electricity at 7.3 $ct/kWh. The solar resource in Dubai for CSP is not the best in the GCC, Saudi Arabia’s North-West has a 30% better resource. So, if we would build a similar plant now in that area, all else being equal, we could achieve a tariff for nighttime solar of around 5 $ct/kWh. Saudi Arabia’s Acwa Power is the developer of the DEWA IV project and they expect that further cost reductions are possible, so it is safe to assume that a large-scale CSP project can potentially produce electricity at 4 $ct/kWh.

A smart combination of large scale solar PV and CSP in the Gulf could provide 24-hour solar electricity for a price of 3 $ct/kWh. Although these numbers sound ambitious, the plan by the Saudi Crown Prince Mohammed bin Salman and Softbank’s Masayoshi Son to develop 200GW of solar energy in Saudi Arabia by 2030 could make that ambition a reality.

Cost of Green Hydrogen in the Gulf

To produce 1 kg of hydrogen requires 50kWh of electricity and since solar energy could cost 3 $ct/kWh in the Gulf, the energy cost to produce hydrogen is 1.5 $/kg. An electrolyser costs approximately $600,000 per MW but is projected to cost $400,000 in a few years from now. Assuming 8,000 annual full load hours, a 1MW electrolyser coupled to a solar system would produce 160,000 kg of H2 per year. Assuming a 10-year life and linear depreciation, this would add 0.25 $/kg to the cost of the hydrogen. The overall cost of green hydrogen made from sunshine and water in the Gulf could be as low as 1.75 $/kg.

Can Hydrogen become the New Oil?

To make green hydrogen at competitive prices, scale and a programmatic approach is required. The ultra-low prices for solar energy will follow in the footsteps of Saudi Arabia’s and the UAE’s solar developments and if they can be coupled to a similarly ambitious hydrogen scheme, the GCC could become a world leader in the field. The abundance of land for large solar plants, the strong industrial and intellectual capacity in the oil and gas sector and the strategic geographical location make it a natural proposition for the Gulf countries.

The following roadmap is proposed:

- Introduce green hydrogen in the ammonia sector2.

- Introduce green hydrogen for use in the domestic power and transport sector

- Introduce green hydrogen for export markets

1. Ammonia

Fertilizers contain a lot of hydrogen. Ammonia (NH3) is the foundation for the nitrogen (N) fertilizer industry and can be directly applied to soil as a plant nutrient or converted into a variety of common N fertilizers, such as urea. In 2017, the GCC countries produced 30 million tons of ammonia and urea, 90% of which was exported. Half of that production was in Saudi Arabia, where SAFCO has some of the largest ammonia plants in the world. SAFCO IV for example produces 1.1 million tons of ammonia per year. To produce that amount of ammonia, 190,000 tons of hydrogen is required, which is currently being produced through steam methane reforming.

When hydrogen is converted into useful energy such as heat, electricity or motion, bit produces only water as a by-product.

The “Power to Ammonia” (ISPT, 2017) study for the Netherlands concluded that if cost-effective baseload renewable electricity (25 EUR0/MWh) is available, ammonia produced in an electrochemical way with electrolysers and air separation units would cost 260-370 EUR/ton. The traditional steam methane reforming process using natural gas produces ammonia at 300-350 EURO/ton. Given that baseload solar electricity can be produced at that price in the Arabian Gulf, green ammonia can, by deduction, be produced competitively.

To replace the SAFCO IV plant with an ammonia facility that uses green hydrogen, a combination of a 1.3 GW solar PV plant plus a 1.3 GW CSP plant would be required to produce the required hydrogen, which is just 1.3 % of Saudi Arabia’s 200 GW solar plan.

2. Hydrogen for other Domestic Purposes in the Gulf

Green hydrogen can be used to transform the UAE power and transport sector in a cost-competitive way. Large projects are required to achieve the scale and price point for a competitive green hydrogen proposition. Building on that experience, producing additional hydrogen for the domestic electricity and transport sector is straightforward. Hydrogen costing 2 $/kg or less provides for lower costs per km in a hydrogen fuel cell vehicle and the fuel cells in these vehicles can be used to produce grid electricity when the cars are not used, which is 96% of the time.

Building a domestic hydrogen industry would also provide a zero-carbon alternative business model for the oil & gas sector. In addition to power and transport, the steel sector would be a potential market for hydrogen, as well as the oil refineries. The International Maritime Organization resolution to reduce harmful emissions in shipping will increase demand for hydrogen that is used in refineries to remove sulphur in transport fuels. If the hydrogen used for this is green hydrogen, the overall emission footprint of the sector can be reduced. But the demand for low-sulphur diesel for road transport is expected to grow globally, with associated increased demand for hydrogen.

3. Exporting Hydrogen

Contrary to hydrocarbons, renewable energy is available everywhere on the planet (although the resources differ from region to region) so green hydrogen can potentially be produced almost anywhere. However, like with hydrocarbons, there will be differences in cost structure, and geographical locations matter. The larger Gulf countries have ample low-cost land, stable economic climates, low cost of capital, existing industrial capacity and an excellent solar resource. The majority of the global population is relatively close by, especially the energy hungry Asian growth markets, and the Gulf countries have reliably served global energy markets with hydrocarbons for decades. The demand for low- and zero-carbon energy solutions, including hydrogen, will increase dramatically in the coming years, and the Gulf countries have an excellent opportunity to be in the driver’s seat of that development. Low-cost green hydrogen produced in the Gulf can be exported in pure liquid form, similar to LNG. Kawasaki and Shell are presently building a first liquid hydrogen vessel.

Another elegant and cost-effective way to transport bulk hydrogen to international markets is by transporting green ammonia. Ammonia is one of the most traded chemicals in the world and transporting it requires less energy than the cryogenic route of liquid hydrogen, which requires cooling to -254°C. However, cracking ammonia in its components hydrogen and nitrogen at the customer’s end also costs energy, so comparing these options requires due consideration.

The New Oil

Using 20% of the UAE’s land surface for solar plants producing green hydrogen for export would suffice to match its current oil & gas revenue. A similar premise exists for other larger Gulf countries, providing an opportunity for a future-proof economic proposition beyond hydrocarbons. The Gulf economies have for decades enabled global economic development by serving energy markets and now have an equal opportunity to contribute to a global energy system that does no harm to the environment.