Unlocking Capital for Energy Access

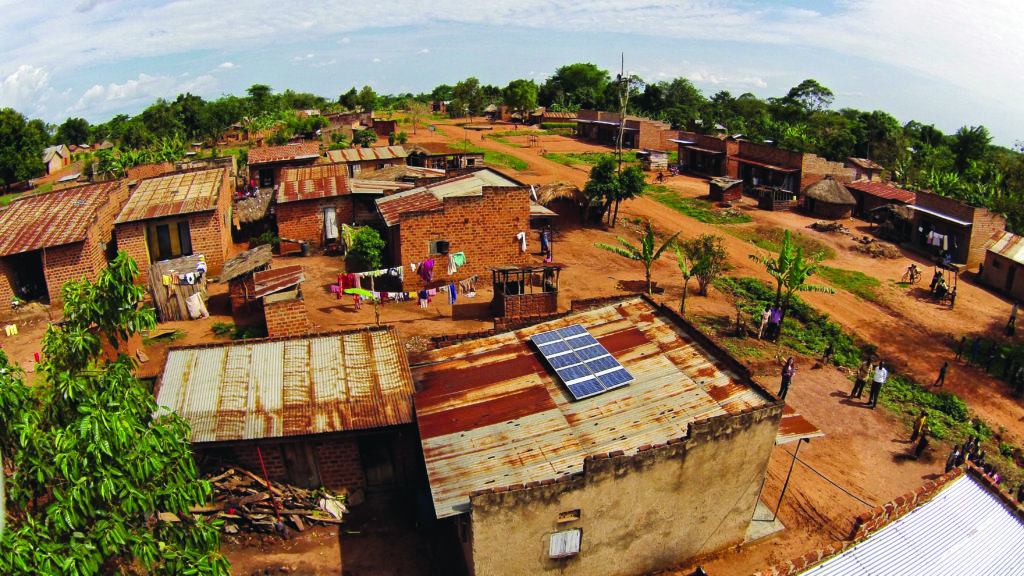

One of the major challenges today is how to expand access to energy to every corner of the globe, so that no one is denied the opportunities that come with being connected to a reliable source of electricity. One way to address this challenge involves using off-grid solar companies, which hold significant potential for delivering energy access to the over 1 billion people currently living without any electricity – and to the many more that have unreliable access to the grid. However, channelling capital to these companies from interested investors has been one of the key bottlenecks for achieving scale.

SunFunder is a specialist finance company that has unlocked $62 million for solar enterprises from 2012-17. In doing so, it has experimented with a range of structures to increase investment – and discovered ways to help the sector scale-up to a long-term sustainable future, sourcing larger amounts of capital from commercial investors.

The Energy Access Financing Bottleneck

Today, more than 1 billion people, predominantly in rural areas, still live without electricity, and over half of which are in sub-Saharan Africa. A new ecosystem of commercial enterprises that deliver off-grid solar energy access solutions in developing countries have made significant inroads to address this access gap. For example, in 2017, these enterprises were providing improved electricity access to an estimated 73 million households comprising over 360 million people. There is an even larger opportunity for growth, with an estimated potential market of 434 million households.

The off-grid solar sector is emerging as an investment success story, with over $550 million deployed in the last two years alone. However, working capital debt for scaling-up has been, and remains, an obstacle for off-grid solar companies year after year. Specialist intermediaries – foremost among them SunFunder, responsAbility’s Energy Access Fund and SIMA, as well as broader investors Global Partnerships, Oikocredit and Developing World Markets – are actively lending capital to impactful enterprises across the sector, and beginning to tackle the capital gap which prevents scale.

But even with this progress, the larger question remains: how do we attract different kinds of investors to scale up solar energy access to its full potential?

Since 2012, we’ve been figuring out how to create new kinds of investment products for the energy access sector. By blending together catalytic capital with private and development finance, we think scaling the SunFunder model with institutional investors is just around the corner.

Ryan Levinson, Founder and CEO, Sunfunder

Matching Capital To Impact

SunFunder was founded in 2012 to address this debt financing bottleneck. Through its series of debt fund raises it has answered part of this question, building the most extensive track record in the sector and offering appropriate fund structures to unlock $62 million as of the end of 2017. The result has been scalable debt financing for nearly 40 companies, including off-grid solar leaders and pioneers, directly improving energy access for over 3 million people.

Initially launched as a crowdfunding platform, SunFunder quickly moved to larger investor offerings through private debt notes. Demand from solar companies for financing exceeded supply, while the timing constraints of crowdfunding reduced flexibility. The first such note, for $250,000, was piloted with four investors in 2013 including the DOEN Foundation in the Netherlands, an early leader in innovative energy access funding more widely, and was used to finance solar companies including early industry leaders BBOXX, Fenix and SolarNow.

Building on this track record, SunFunder offered progressively larger, longer-term debt products, raising $15 million from 2013 to early 2016. A key innovation to attract investors with a lower risk appetite was a tiered capital structure, with a first-loss junior layer offering a higher return, which reduced risk for senior investors.

In 2016, SunFunder launched a larger fund, ultimately closing $47 million with a mix of private capital (from impact investors, foundations and high-net-worth individuals) and development finance institutions, led by OPIC, Facebook and The Rockefeller Foundation played a particularly catalytic role by providing junior capital which was critical for the fund’s risk profile. The size of the fund meantthat SunFunder was able to deploy solar loans averaging $1.2 million as of the start of 2018, with larger facilities in the pipeline.

The company has now started raising a new $100 million Solar Energy Transformation fund, which will again present a significant opportunity to investors with a range of profiles — and continue to enable institutional investment for energy access.

Lessons from SunFunder’s Approach

In the course of unlocking over $62m for the energy access sector through innovative investment products, SunFunder has experimented with and learned from several approaches which could serve the industry widely.

Building Track Record to Involve Different Kinds of Investors

A key part of SunFunder’s strategy was to offer different investors, with varying risk appetites, a route into the energy access sector. The profiles of these investors have changed over time as SunFunder built its track record and the sector matured more generally. For instance, foundations and impact investors paved the way for public institutional capital from development finance institutions. SunFunder’s own capital was required to initiate the first riskier junior layers.

Blending Private Finance

‘Blended finance’ is typically used to describe the pooling of public funds to mobilize private sector capital. But SunFunder’s early experience of blending was with different sources of private rather than public capital. This shows that offering aggregation opportunities to private investors who themselves have different risk appetites can be highly effective.

The larger question remains: how do we attract different kinds of investors to scale up solar energy access to its full potential?

Catalytic Capital Has a Multiplier Effect

SunFunder’s biggest constraint has been the relative lack of first-loss capital at workable pricing to help deliver an overall risk profile attractive to other investors. Junior first-loss capital in SunFunder’s debt funds has been fundamental to their overall success by catalyzing senior and mezzanine investors further up the capital stack while delivering appropriate fund economics. Investors that take firstloss layers in structured funds can unlock multiples of their own investment, which in SunFunder’s case was best illustrated by the successive first loss grants by Facebook, which achieved 14x and (alongside The Rockefeller Foundation) 11x multipliers respectively.

Tiered Fund Structure

SunFunder achieved blending through different capital layers in its funds. This has not been static, with models adapted when needed to respond to investor interests and experience. Notably, the new $100 million Solar Energy Transformation fund has a simpler capital structure of only junior and senior layers.

Early Investors Willing to Innovate

SunFunder benefited from supportive early stage investors who were willing to engage with new fund structures, new products and an uncertain ecosystem. This includes both individuals who believed in the model before it was proven, as well as institutions that pioneered new innovations.

Concessional Pricing

The long-term sustainability of energy access financing relies on building a track record to enable pricing on a commercial basis— but when SunFunder started, an important feature of its initial funds was the concessional returns accepted by impact-oriented investors. The commercial potential of the sector can prompt concessional investors to demand high returns too early, for instance through high pricing requirements or risk protection. Institutions mandated to deploy catalytic capital can be overly conservative. Concessional investors that could provide grants but expect high-interest returns from riskier debt investments should consider lower-return program related investments as a best of both worlds.

Commercial Investors Need Comparably Higher Yields

The comparables that commercial investors use when looking at SunFunder’s fixed income opportunities are high yield emerging market corporate bonds and Collateralized Leveraged Obligations (CLOs), which offer returns currently ranging from around 5 percent to 8 percent. Attracting commercial investors into the sector at scale means that catalytic capital will continue to be needed in the near term for intermediaries like SunFunder to remain competitive for solar borrowers, especially compared to other direct lending by concessional investors.

The new $100 million Solar Energy Transformation fund present opportunities to investors with a range of profiles

Long-Term Partnerships Allow Learning by Doing

Innovative long-term partnerships are crucial for supporting and testing new fund models. SunFunder benefited from having investors, like Facebook and the DOEN Foundation, who participated multiple times and were willing to innovate as they gained first-hand experience of the company’s growing track record and potential for scale.

Concessional Finance Must Minimize Distortion

As the working capital needs of the leading off-grid solar companies have reached ticket sizes of interest to larger concessional investors, including but not limited to development finance institutions, there is a real risk of distortion. In several cases, SunFunder has been squeezed out of deals with solar companies by non-specialist investors offering highly concessional rates directly—on more than one occasion by institutions that had also invested in SunFunder’s debt funds. This hinders the sector moving to further maturity, and prolongs the need for concessional capital in financial intermediaries. This is even more the case going forward as intermediaries seek to unlock commercial capital through blendedfund structures—a step that will be fundamental to the sector’s long-term financing needs.

This article is based on SunFunder’s “Scaling Energy Access with Blended Finance: SunFunder and the Role of Catalytic Capital” available at www.sunfunder.com/blending

Water problems in Southeast Asian deltas can only be solved if government strategies and techniques are linked with tactics developed by local people and which are embedded in their culture and history. We need to listen to their stories, understand their tacit knowledge and ask: What do you need to cope better with climate change and urbanization?

This brings me back to the village erected on Chau Doc in Vietnam’s Mekong Delta. Here, I realized that the power of water may push more and more rural people to migrate to places where they may become trapped into the vicious cycle of poverty. This should be an important motivation in the realization of plans for all those threatened delta regions in the world: to give hope and provide a new future to people who are not able to escape poverty. In other words: don’t make plans to make money on the Mekong, but improve living with the Mekong.