5 Myths about India’s Energy Transition

As a developing country, India needs to prioritize affordable and reliable power for all.

Many have been advocating for up to 60 GW of new coal power under the false belief that there is a trade-off between the environment and development. This belief is based on 5 faulty myths about India’s journey down the road of renewables.

Myth #1: India Has Installed a Lot of Renewable Energy

One of the main reasons cited for turning back to coal is that India has installed a lot of renewable energy and still has demand shortages, therefore needs coal. However, the fact India is an emerging economy with high demand growth is a reason to build *more* renewables, not less.

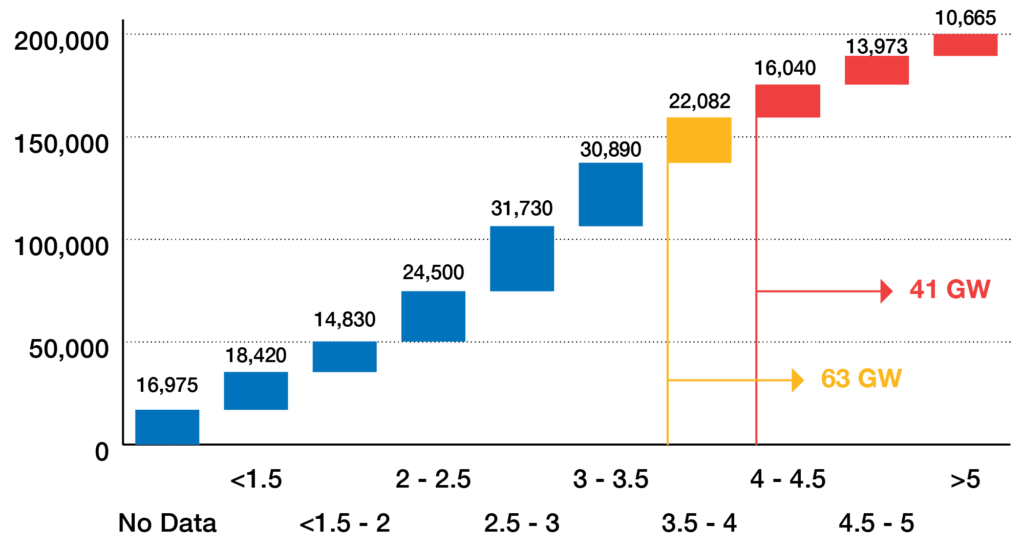

For example, over the last 5+ years, India has installed 8-15 GW of renewable energy. However, at least 50-60 GW is required to meet demand growth, as shown in Figure 1.

The second point often made is by comparing India to other countries. For example, it is often cited that India has passed Germany (or Japan) to have the third-most installed solar capacity in the world. While India does have a comparable amount of solar power installed vs. Germany, India has a much stronger solar resource (and therefore should be doing more, not less).

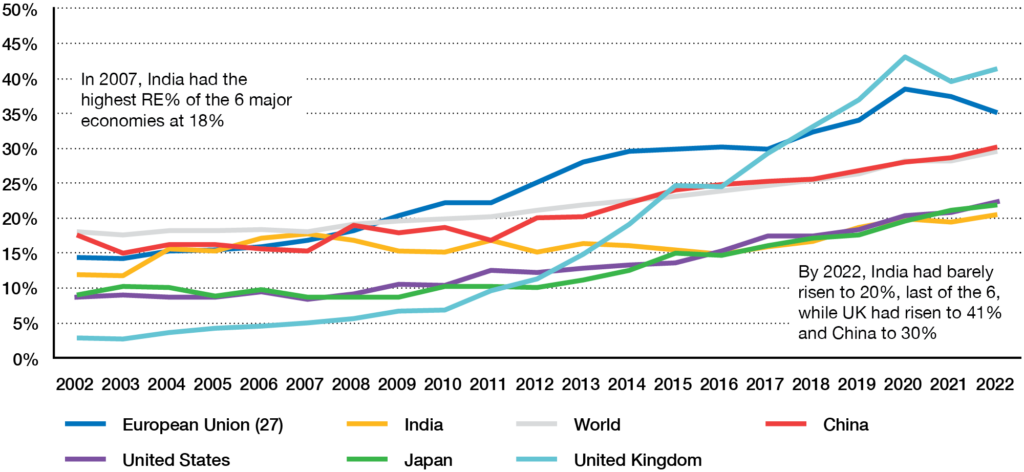

More importantly, India’s electricity demand is 5x Germany and India’s population is 20x Germany. This author believes that Indians are just as deserving of power as Germans, and therefore should be installing just as much capacity per capita, not just in absolute terms. India has been falling behind its peers in terms of percentage of electricity from renewable energy sources. In a highly competitive global environment, where manufacturers seek affordable, clean power, this puts India at a significant competitive disadvantage.

It is also worth comparing the RE installations against the government’s own targets. In the Central Electricity Authority’s National Electricity Plan 2018, the government targeting 100 GW of solar and 60 GW of wind by 2022 (to partially meet demand growth, the NEP also envisioned substantial new coal). As of 31 March 2017, India had 12.3 GW of solar and 32.3 GW of wind, meaning the target installations was 87.7 GW of solar and just 27.7 GW of wind over 5 years, an already modest target, given India’s demand growth (as shown in Figure 1).

However, India installed just 41.7 GW of solar and 8.1 GW of wind, just 48% and 29% of these already modest targets, along with just 2.2 GW of hydro (33% of planned). Note the overall *capacity* of RE has grown, but since relatively high-CUF hydro has been replaced with relatively low CUF solar, this has resulted in thermal generation roughly flat at 74%, as shown in the below figure from the CEA.

On a related note, India’s 500 GW renewable energy target is often cited as “ambitious”. However, given demand growth of 5-6%/year and the number of coal plants that have reached end-of-life and need to be decommissioned (for technical, not climate reasons) India needs between 720-860 GW of renewable energy by 2030. This does not include additional RE required for green hydrogen (125 GW), to displace diesel generator usage, or displace high-cost coal (see next Myth).

Myth #2: Renewable Energy is More Expensive than Coal

The second major reason cited for new coal expansion is that Indians need “affordable” power. It is certainly true that Indians need affordable power, and renewable energy is substantially cheaper than new coal. For example, new solar is about Rs. 2.5/kWh, while new wind is about Rs. 3.25/kWh. In contrast, India has 63 GW of coal with a *variable* cost higher than Rs. 3.5/kWh, as shown in Figure 3.

The All-India APPC (Average Power Procurement Cost) has in fact risen from Rs. 3.85 in FY22 to approximately FY 4.56 in FY23 on the back of higher coal costs. And this is the average, including legacy coal plants where capital costs have been fully amortized. New coal tends to be even more expensive. Figure 4 shows the cost of new coal plants built in the past 3 years versus the cost of “Firm” Renewable Energy (more on this in the next section).

New coal in India costs around Rs. 5.5/kWh, whereas new RE + storage at an equivalent level of reliability costs Rs. 4.0-4.5/kWh. Therefore, the 90 GW of new coal being planned will cost Indian consumers/DISCOMs 63,000-95,000 Crore ($80-120 billion) per year extra in electricity bills – a cost a developing country like India can ill afford.

Myth #3: Renewable Energy is Unreliable

It is true that renewable energy is variable and uncertain, and does not provide firm power, on its own. This is why it is so crucial to deploy energy storage. Early “RTC” RE tenders (like SECI RTC-II, which was Rs. 3.30/kWh, the outlier in the above chart) were based on Capacity Utilization Factor, which just means more energy, not necessarily more “firm” power. In contrast, other tenders like REMCL RTC-I have specified an availability of 85%, the same as existing coal plants, and still have a competitive price (Rs. 4.25/kWh). Furthermore, these tenders specify a penalty (usually 200%-300% of the tariff rate). In contrast, coal plants do not have to pay a penalty to the DISCOM when they are unavailable, making these RE + storage contracts actually *more* reliable.

Furthermore, storage has additional reliability advantages over coal such as:

- can be built in 3-6 months vs. 4-6 years for new coal

- can be sited anywhere (unlike coal which requires significant land and cooling water)

- can be scaled modularly from rooftop or microgrids, to GW-scale

- can react in milliseconds, providing better grid frequency control (vs. minutes to hours for coal)

- do not suffer a partial loading and turn-off/turn-down penalty like coal

From a capacity perspective, new storage is substantially cheaper than new coal.

There has been much confusion about energy storage. In particular, many stakeholders say energy storage is expensive because they are computing an “energy” cost for storage. But the energy comes from wind and solar, which (as discussed above) is lower than the variable cost of fossil fuels. Energy storage provides the firm *capacity* to meet the variability and peaks of load (as well as low-RE periods). From a capacity perspective, new storage is substantially cheaper than new coal, as shown in Figure 5:

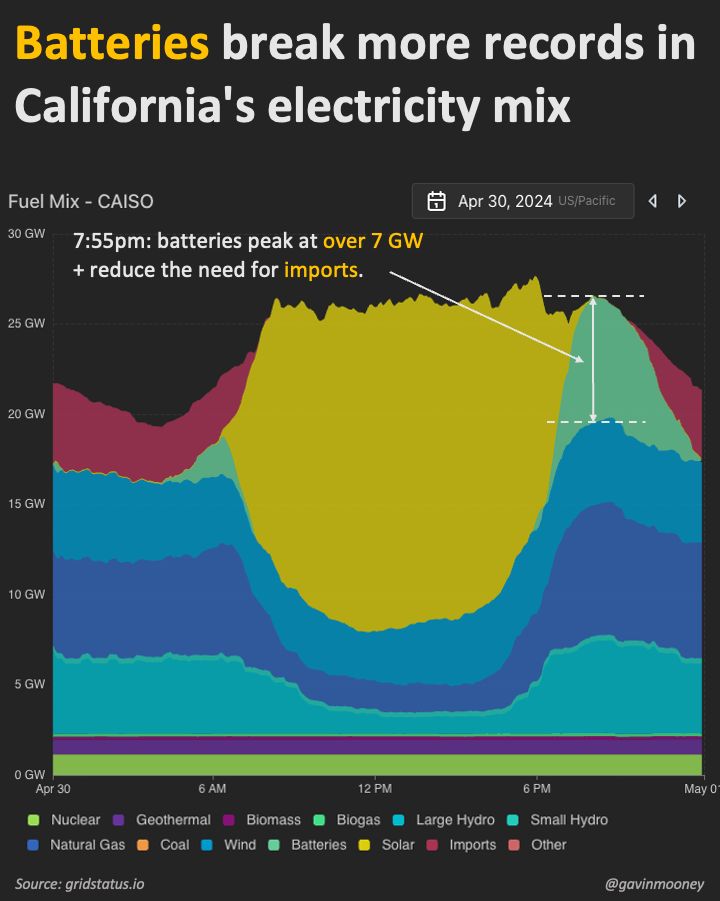

Another big confusion is the amount of storage required. In the long-term, LDES will be required to move to a 100% RE system. However, India only receives about 11% of its electricity from variable renewable energy (wind and solar). In places with much higher levels of VRE like California (26%), UK (35%), Germany (33%), 2-4 hours of storage has been shown to provide much higher levels of reliability as coal in India (shown in Figure 6). In fact, the only two major economies that are >70% dependent on coal (India and South Africa) have much lower reliability than economies which rely on energy storage to meet reliability requirements.

Myth #4: Renewable Energy Harms Energy Security

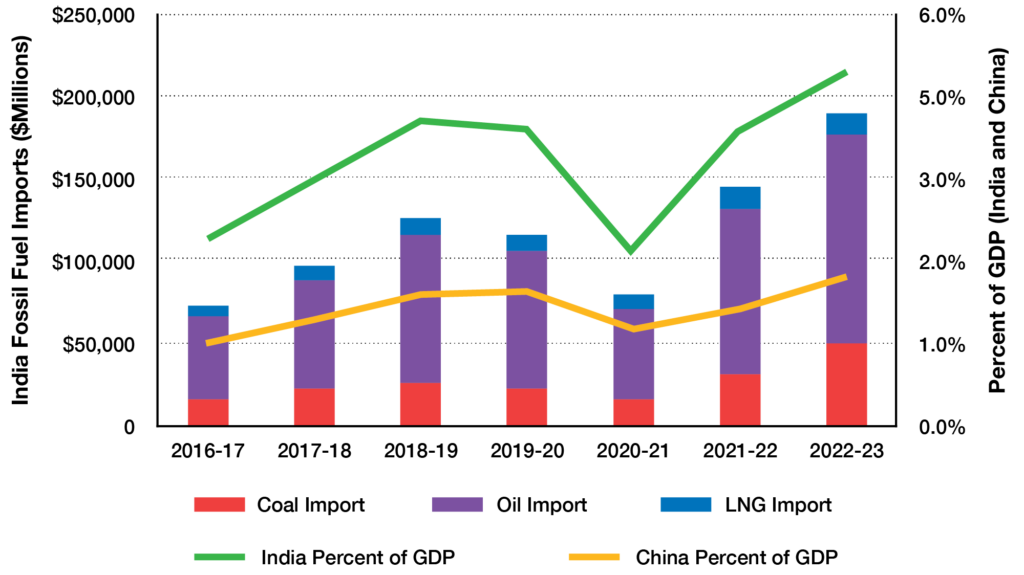

Another big myth is that India must rely on coal for “energy security” reasons. This stems from a confusion about stocks and flows and the nature of renewable energy itself. While India imports 21% of it’s coal, it imports 0% of wind and solar. Yes, wind and solar equipment may be imported, but once installed it is completely energy secure, the supply cannot be cut off. In contrast, fossil fuels like coal and gas must be continuously re-imported year after year, creating a perpetual energy security risk. In fact, fossil fuel imports reached over 5% of GDP in India last year, vs. 2% in India’s largest geo-strategic rival, China. The main reason China has been able to keep its fossil fuel imports in check has been because of investments in renewables and electric vehicles, as shown in Figure 7.

In fact, between 2018 and 2023, while India has been claiming it cannot install renewable energy for “Energy Security” reasons, India imported $94 billion in thermal coal (excluding coal used for industrial processes like steel manufacturing). If that money was spent on importing cells for solar modules (India is self-sufficient in solar module production, but imports much of the components), India could have imported 1,050 GW of solar cells, over 10x actual installations, and completely eliminating India’s energy security concerns (note India is largely self-sufficient in wind turbine manufacturing and battery pack assembly, though like solar, some of the component for battery packs are imported). In fact, for a typical solar, wind, and storage project, less than 20% of the components are imported, the rest is assembled in India (or goes to land, labour, and taxes). This is less than the percentage of coal that is imported and far less than the 50% of natural gas and 80% of oil that is imported.

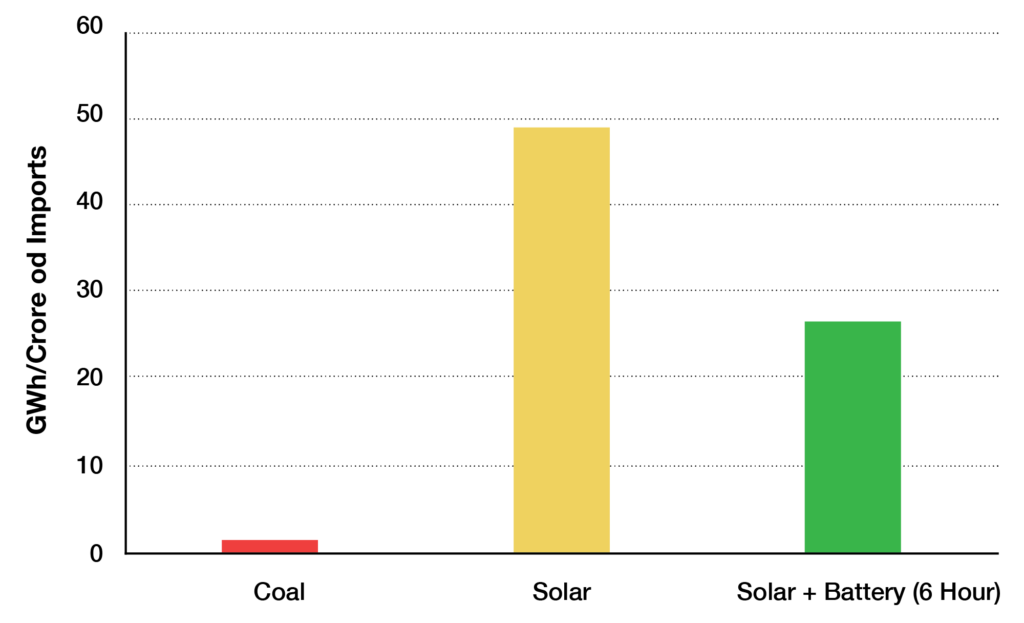

Most importantly, the amount of energy generated per Crore (or dollar) of imports is substantially higher for renewable sources than fossil fuels, as shown in Figure 8. Ultimately, if India wants to reduce energy imports (and therefore improve energy security), renewable energy (even if imported) is a much strong bet.

Myth #5: Policy Favours Renewable Energy Over Coal

The final myth often told is that India’s policy favours RE and if it truly is economic and reliable, it will get built. This belief seems to stem from two main perks provided to renewable energy, the ‘transmission waiver’ and banking.

The transmission waiver means RE projects do not have to pay transmission charges, saving them about Rs 0.30-0.40/kWh. As discussed in Section 3, even if this cost is included, RE + storage would still be substantially cheaper than coal. Secondly, the transmission waiver has had the perverse incentive of pushing RE projects to the best sites (such as in Rajasthan and Gujarat), weakening local buy-in (for example, the Uttar Pradesh government would rather have a local coal plant than “imported” renewable energy). If the transmission waiver was removed, we would see much more solar and wind around the country, bolstering local engagement. Banking meanwhile exclusively benefits large corporate and industrial customers, but actually puts a burden on the DISCOM (as they must manage the time shifting and variability), discouraging them from building their own.

On the other hand, there are numerous policy-supported mechanisms for coal not available to renewable energy, such as:

- Government Provision of Land (and Water) for Coal Plants.

This is especially crucial for wind parks, which require land in high wind-speed areas. Though India has developed <3% of its wind potential according to NIWE (a government agency) state/central government have generally not allocated land for wind parks (with notable exceptions like Khavda).

- Guaranteed Return on Equity (RoE) of 15.5% for Coal Plants.

In contrast, RE and storage projects are subject to competitive tendering with L1 price matching.

- Planning Which Builds Coal by Default.

Though India has suggested a Renewable Purchase Obligation (RPO) on states (which has not yet been enforced), it is seen by states as a ceiling rather than a floor. In most states, even if they plan to meet RPO, they then automatically build coal to meet the residual demand, rather than doing any economic or reliability analysis of coal vs. RE + storage. Similarly, at the central level, the Central Electricity Authority has taken the 500 GW target as a default, rather than determining the most optimal amount of renewable energy.

- Concessional Tax Rates for Coal.

Coal has a GST rate of 5% vs. 12%, 18% or 28% for solar, wind, and storage equipment (depending on sub-category). Similarly, coal has an import tariff of 1% vs. 40%+ for solar, 22%+ for wind and 24%+ for energy storage. Furthermore, there are non-tariff barriers on solar and wind such as ALMM and RLMM which block low-cost imports and place an additional regulatory burden on small and medium domestic manufacturers.

- Higher Availability Requirement for RE + Storage Projects.

While coal plants have a nominal availability of 85%, there is no penalty on the generator when they are unable to meet demand due to forced outages, water stress, and coal availability. In contrast, RE + storage is often required to meet 90%+ availability and must pay a penalty for any shortfall.

- Minimal Consideration of the Externality Costs of Coal.

While coal pays a nominal “cess” of Rs. 400/tonne, this is a fraction of the externalities imposed by land, water, and air pollution. Air pollution from coal plants alone costs over 200,000 lives per year in India. If this were reflected in the coal cess, the coal cess would rise to at least Rs. 6,000/tonne, not to mention the additional health costs, lost agricultural productivity, and other.

Fundamentally, in policy circles across the country, renewable energy is viewed only from a climate lens, whereas coal is viewed as essential for the development of the country. Until renewable energy and storage are treated as crucial to development, they will continue to suffer from a policy disadvantages, both formally (via taxation rates for example) as well as informally (such as DISCOM’s prioritizing payments to thermal generators).

What is the Path Forward?

India has many phenomenal companies and individuals leading in the renewable energy space. There is ample capital both domestic and international seeking to invest in India’s tremendous growth story. There are literally thousands of GW of resource potential (both solar and wind) across the country. So how can India become a greater leader in renewable energy?

- Put Coal and Renewable Energy on an Even Playing Field

Revamp state and central planning processes to minimize cost and maximize reliability to consumers. Cancel all planned coal projects and have them bid in competitive auctions against Renewable Energy + storage, for the same level of reliability (and the same penalties for shortfalls). While some mine-mouth plants may be able to compete, recent history suggest that virtually no new coal is economic against RE + storage. It would also substantially lower costs if RE were to get some of the same benefits as coal such as lower tax rates and land allocation.

- Drastically Scale Up RE in Line with Demand Growth

The commitment to tender at least 50 GW per year of RE is a step in the right direction. However, this must flow to both central and state level targets that are in line with demand growth. At the all-India level, this means at least 720 GW of renewable energy by 2030 (about 80 GW per year), and potentially even more to have a sufficient reserve margin, as is common practice in developed countries.

- Build Energy Storage on an Urgent Basis

Despite having ~6.5% of India’s electricity demand, India has installed about 0.1% of the global Battery Energy Storage Systems. Indians deserve affordable, reliable power just as much as anyone else and it is crucial to deploy firm resources like energy storage to meet peak demand and end the outages plaguing the country. Energy storage is already much cheaper than coal and can be deployed in less than a year to meet India’s growing demand vs. 5 or more years for new coal projects.

Renewable energy is much more affordable than coal. Storage is far more reliable. Together, RE + storage can support India’s development and end the ongoing power outages, improving energy access and affordability for all its citizens. But only if we dispense with the many myths holding back the renewable energy sector and put it on a level playing field with coal.