CBAM: What Is It and Why Is It Needed?

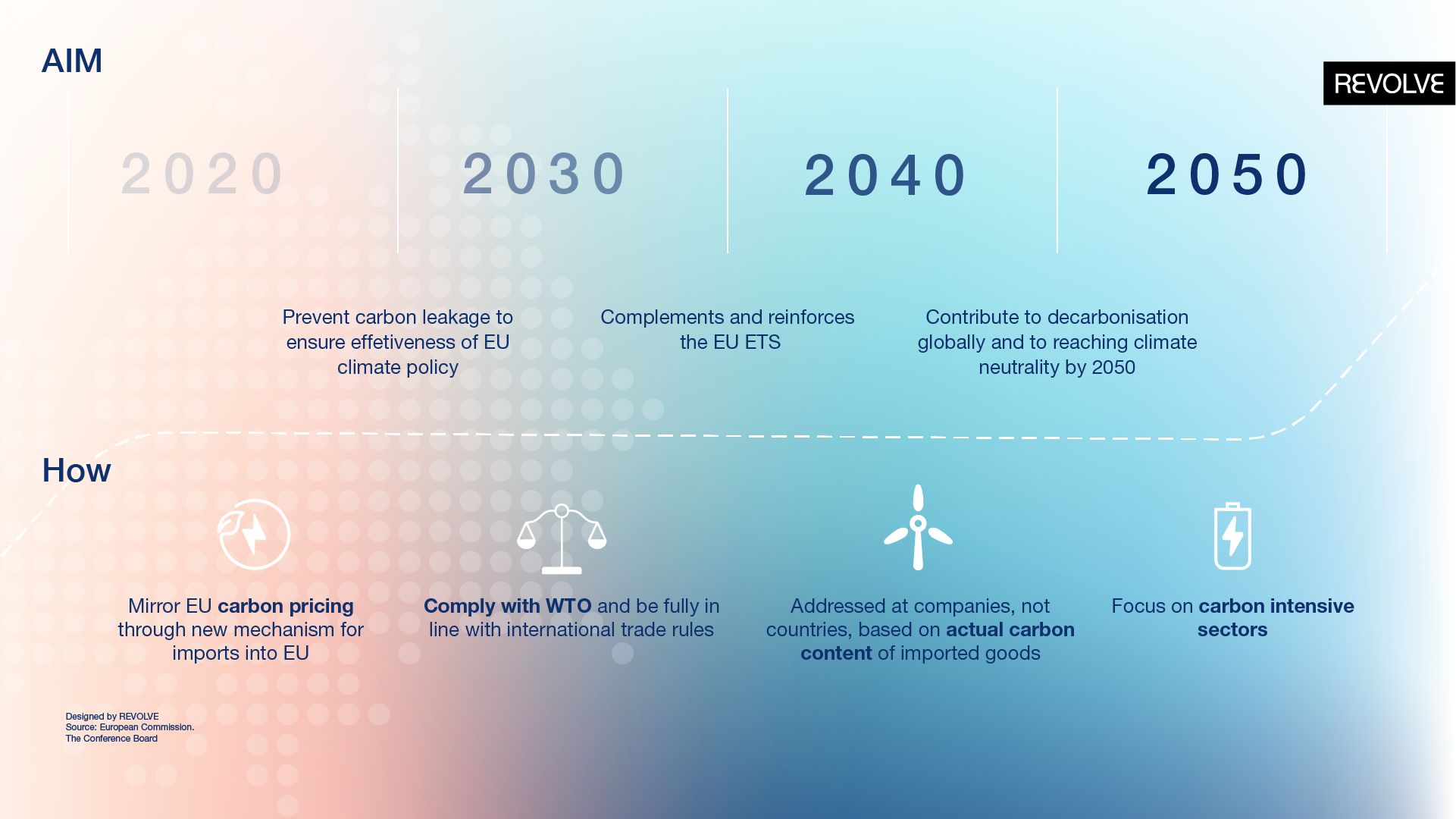

In a bold move to combat climate change, the European Union (EU) has set an ambitious goal: a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels.

Currently, the EU employs the EU Emissions Trading Scheme (EU ETS) to regulate emissions in certain sectors, but concerns linger about companies potentially relocating production to dodge emission costs—a practice known as carbon leakage.

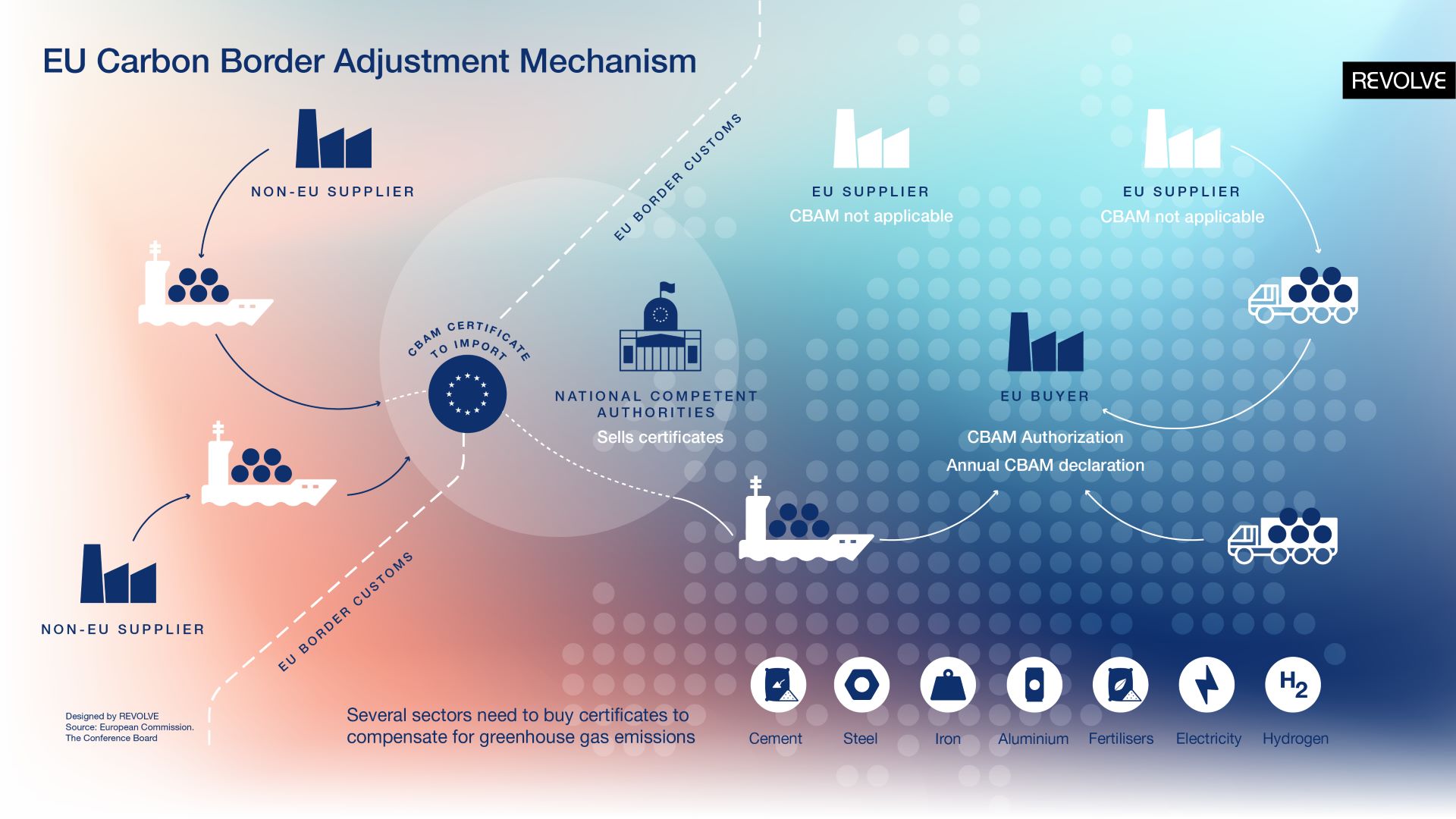

Enter the game-changing solution: the Carbon Border Adjustment Mechanism (CBAM). This innovative approach aims to level the playing field by ensuring that both goods produced within the EU and those imported from outside carry comparable carbon costs. This means that companies boasting lower emissions during production will enjoy a competitive edge. While EU-based businesses have been diligently reporting their emissions since the inception of the EU ETS in 2005, a new twist comes into play—importers are now mandated to report the emissions linked to the production of their imported goods, effective immediately.

In a bold move to combat climate change, the European Union introduces the game-changing Carbon Border Adjustment Mechanism (CBAM) to level the playing field by ensuring comparable carbon costs for both domestically produced and imported goods

CBAM is targeting initially the imports of specific goods and their precursors with carbon-intensive production processes. This includes cement, iron and steel, aluminum, fertilisers, electricity, and hydrogen – industries deemed most susceptible to the risk of carbon leakage. As CBAM evolves, its scope is expected to broaden, eventually encompassing over 50% of emissions in sectors covered by the ETS once fully implemented.

Shortly preceding the January 31 deadline for importers to submit their inaugural CBAM report, the European Commission has granted a discretionary 30-day extension in response to technical complications associated with the CBAM Registry.

Looking ahead to 2026, importers will be mandated to surrender CBAM allowances to counteract embedded emissions in imported commodities. The obligation to surrender is tempered if EU producers receive complimentary allocations, aligning with the effective carbon price paid in the country of origin, where applicable.

A transitional phase until 2025, featuring simplified monitoring rules and exempt surrendering obligations, paves the way for this innovative instrument targeting embedded emissions in imported goods from 2026 onward.

Considering the novelty of CBAM as an instrument necessitating data from operators not previously covered by EU ETS 1, a transitional phase will be implemented until the end of 2025. This phase entails simplified monitoring rules, suspended external verification, and exempt surrendering obligations. Post-2025, surrendering requirements will be gradually introduced, accompanied by a reduction in free allocation to EU producers to ensure fair treatment of goods manufactured within and imported into the EU.