Rare Earth: Chinese Shadows on “Green” Growth

From iPads to Tomahawk Missiles

For a long time after the Second World War, these metals were under-exploited. They were considered to be mere byproducts of the refining process of other metals and were used by metallurgists as “mischmetal” (an alloy or lanthanum, cerium and neodymium) for the purification of cast irons and steels, or incorporated in alloys such as those used for making flint.

Around the 1980s, major developments in information, military, space and “sustainable development” technologies opened up new applications for the specific properties of these metals that we now live with – most often without knowing.

Another inconvenient truth: our “green” technologies, our production of renewable energy, our inseparable companions – the iPad, iPhone and iPod – and countless other products in our economic model, rely on those rare earth elements – China monopolizes their production and supply.

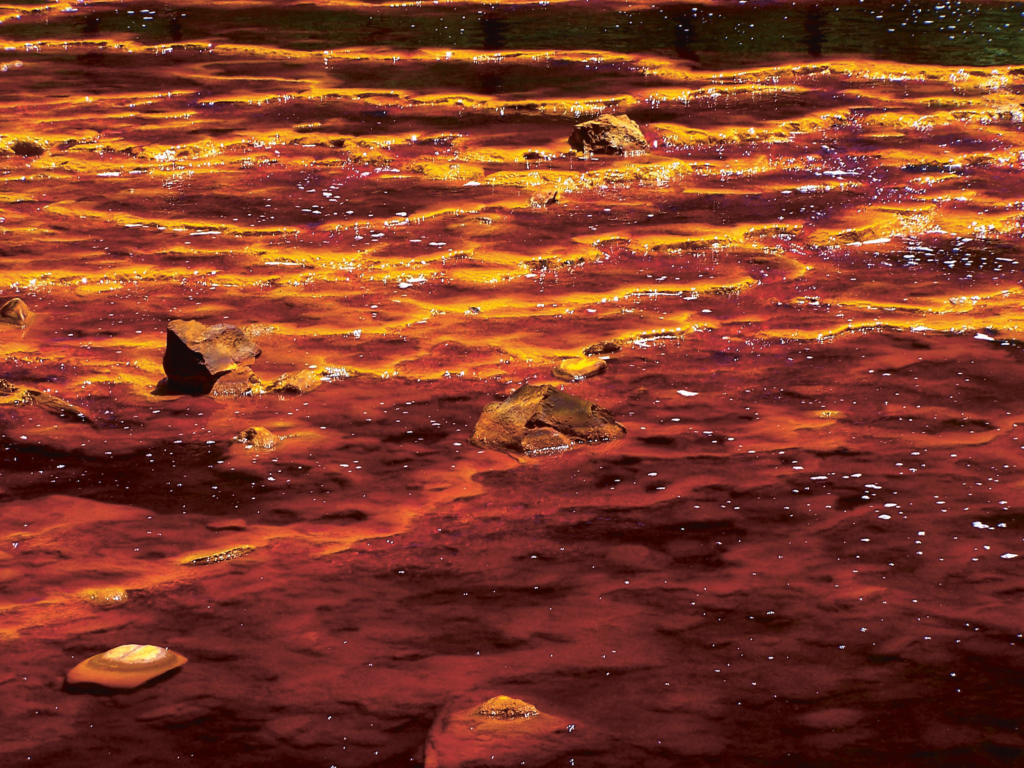

Another black spot on “green” labels: the mining of the resources requires vast quantities of chemical products, releases radioactive substances, and operates in disastrous sanitary and environmental conditions.

Do you drive a hybrid vehicle? Toyota’s Prius model requires several tons of rare earths every year (mostly lanthanum) for the production of its batteries alone. The magnets used in a single 3 megawatt wind turbine, require hundreds of kilos of dysprosium. No iPods work without neodymium and no TVs without yttrium. You want to drive cleaner? It will cost 40 grams of cerium for each catalytic converter…

There is no need to pursue this inventory to see that today rare metals flood our most popular products. Taking notice perhaps a little late of the importance of these elements for the continuity of an economic model still founded on growth, the European Union published a report in June 2010 bringing to light the strategic significance of these resources beyond their uses in our everyday consumption.

In the United States, the Defense and Energy departments emphasized the importance of secure and abundant access to rare earths for the preservation of the country’s research and development (R&D) capacities and military superiority. In 2010, a General Accountability Office (GAO) report – “Rare Earth Materials in the Defense Supply Chain” – underlined rare metals’ critical role in the weapon systems. In February 2011, the United States Magnetic Materials Association (USMMA) called on the U.S. government to create a strategic reserve of rare metals.

Rare earth elements (REE) taint the green economy.

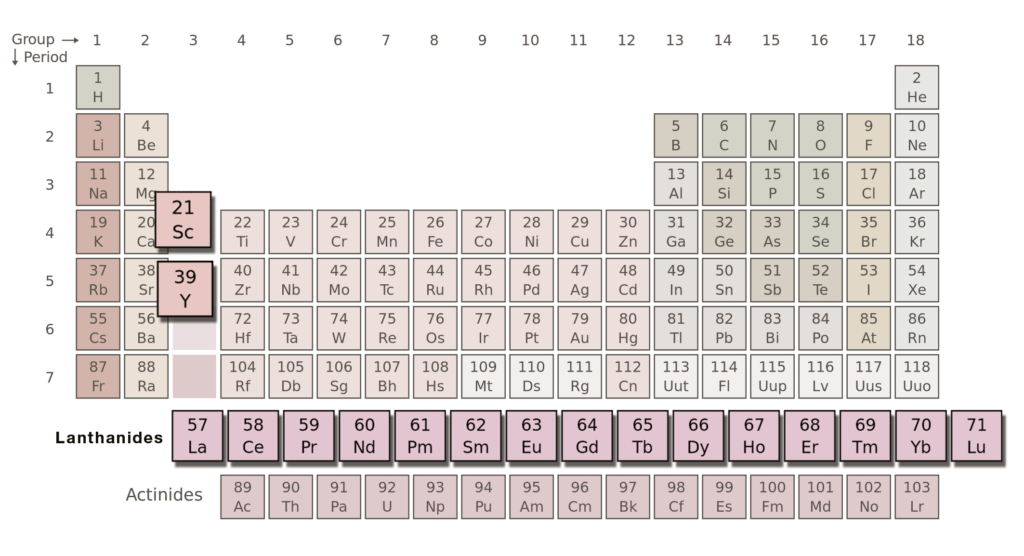

REE are the group of 17 metals at the bottom of the Periodic Table discovered in the 1940s when research was being carried out on the properties of plutonium. These 17 rare metals consists 15 metals from the lanthanides chemical series and the 2 transition metals – scandium and yttrium. These complicated names are reserved for scientific use and most of us are quite oblivious to the services they fulfill every day.

More recently, a report in April 2012 by the Congressional Research Service (CRS) – “Rare Earth Elements in National Defense: Background, Oversight Issues, and Options for Congress” – presented a series of recommendations to Congress after having enumerated an exhaustive list of weapons whose dependence on rare earths was critical. The propulsion systems for the new class of hybrids DDG-51 destroyers requires neodymium for the magnets of its electric motors, dysprosium is indispensable for the stealth systems on drones and fighter jets, Tomahawk cruise missiles, Aegis Spy-1 radars, “smart bombs”… the list is long and the conclusion is clear: more rare metals, more weapons.

Unequal Distribution and Chinese Dominance

Contrary to what their name suggests, the “rareness” of these elements does not explain their strategic nature in the development of weapon systems or consumer goods. According to estimations, neodymium and lanthanum exist in larger quantities than lead and cerium is more widespread than copper. Dysprosium and samarium reserves are apparently larger than those for tin and even the rarest of these elements, thulium and lutetium, are 200 times more abundant in the Earth’s crust than gold. A first explanation for this relative “rareness” is economic: these rare metals are present only in weak concentrations so in order to extract them, huge quantities of earth must be dug and filtered, which involves massive mining costs.

The second problem is distribution. According to the United States Geological Service, around 37% of the world reserves are located in China. This number may have been overestimated and could be 23%, according to the first White Paper published by the Chinese government in June 2012. Approximately 17% of known reserves are in Russia, while the United States has about 13%. Few regions are completely lacking in these resources and the reserves to be discovered are potentially enormous. According to a Japanese study published on July 3, 2011 by Nature Geoscience, the Pacific Ocean bottom could hold up to 90 billion tons of rare earth elements – a staggering quantity in comparison to the 100,000 tons of current annual production.

China controls 97% of the world’s production of rare earth today – a monopoly that nobody saw coming.

China controls 97% of the world’s production of rare earth today – an apparent monopoly that nobody saw coming. Since the 1960s and until the beginning of the 1990s, the largest rare earth extraction mine was Mountain Pass in California, now owned by Molymer Corporation. The United States was the world leader in rare earth production, but at a time when demand was still weak and prices were low. Not very profitable, Mountain Pass closed in 2002 while the R&D budget for the Ames Laboratory – then world leader in the field – was cut further, thereby depriving the United States of its expertise.

An opening was made for the Chinese monopoly to consolidate. Chinese production of rare earth had already increased by 40% between 1978 and 1989. In the context of a national R&D program for state of the art technology launched in 1986 by Deng Xiaoping and capitalizing on weak environmental and social regulations, China developed its rare earth sector in a long-term strategy aimed at controlling the entire chain, from the extraction and transformation to the production of finished and semi-finished goods.

As of 1988, China overtook the USA as the first producer worldwide. An initial balance was struck: the Chinese economy was liberalizing, while consuming countries – Japan, the United States and the European Union mainly – could supply their markets at significantly lower prices than the extraction of their own resources would have allowed, and simultaneously transfer the burden of environmental management of such an industry to China.

China therefore has a monopoly by default much more than through geopolitical calculation. Incapable of anticipating the spectacular rise in demand that was already presaged in the 1990s and incapable of escaping the “market” ideology and shouldering the political costs of a competition with China, the other actors withdrew. China’s production monopoly gives it sweeping market power and price-fixing. Increasing global prices reduce local production costs all the while accelerating technology transfers through the outsourcing of foreign companies to its territory. But how can those complaining today be surprised by what is after all nothing more than an elementary principal of their own economy?

Devious Environment Arguments

As the almost exclusive worldwide producer (97%), China has become increasingly, following its skyrocketing growth, the main consumer of rare earths. As domestic demand develops, the country reduces its exportation quotas. In 2006, China exported 61,560 tons of rare earths of the 86,520 tons officially produced, or more than 70%. In 2011, 93,800 tons were officially produced, but the Chinese government had set the exportation quotas at 30,246 tons, barely 32%! The consequence: prices increased tenfold between January 2010 and January 2011.

Confronted by these exponential and severe exportation restrictions imposed by China, the European Union, Japan and the United States – who, combined, use over 90% of Chinese rare earth exportations – decided in March 2012 to register a joint complaint with the World Trade Organization (WTO). In July 2012, with no agreement in sight, the WTO litigation body established a “working group” that has six months to submit a series of recommendations that China would be obliged to respect.

These will be difficult to enforce given that China has some solid arguments in its favor. First, it justifies its quota policy by the necessity to eliminate illegal mines which, according to the United States Geological Service, accounted for 17-36% of total Chinese production between 2006 and 2011. From China’s perspective, the eradication of illegal mines is indispensable for the preservation of their resources, which depends on reinforcing public oligopolies, but also on reducing overall production. However, as a strong emerging economy, China has to maintain its own supply and make decisions to determine strategic stocks for the most critical rare earths.

The first adjustment variable was naturally to adjust exportation quotas. The second argument justifying exportation quotas is far more devious. Heavily criticized for the catastrophic management of the environmental consequences of the extraction process, China claims it wants to support a “sustainability” principle in managing its rare earth resources.

Concerned about their supply, Western countries prefer not inquiring too much about the conditions in which the mines are exploited. In Baotou, Mongolia – the world capital of rare earths guaranteeing nearly half of China’s production – the city is permanently crushed by thick acrid smelling smog. Local authorities have begun to recognize the existence of these negative health and environmental consequences, but that has a cost and in order to confront these challenges properly, China must stop “selling its earths worth gold at carrot prices” as Chinese economists have noted.

It is in China’s interest then to refer to the exceptions in Article XX of the General Agreement on Tariffs and Trade (GATT) in 1947. This article foresees “particular cases” in which members can be exempted from the general rules of international commerce. Indeed, two exceptions specifically concern environmental protection. Paragraph (b) of Article XX authorizes WTO members to adopt measures contrary to the GATT discipline provided they are necessary for the protection of the health and life of people and animals or for the preservation of plant life. Paragraph (g) authorizes such measures to conserve non-renewable natural resources, if such measures are conjointly applied with restrictions on the national production or consumption.Of course, the introductory paragraph of Article XX stipulates that these measures cannot be applied in any way to constitute a means of arbitrary or unjustifiable discrimination between countries or disguised restrictions on international commerce, which is what the United States, the European Union and Japan will try to show…

Imaginary Wars

The controversy of rare earths elicits catchy titles: “Will wars over rare earths take place?” The situation is undoubtedly critical, namely in light of the crucial importance rare metals play in the evolution of military arsenals. But solutions exist.

The Mountain Pass mine in California has just resumed its activities and should enter into stable production in 2014-15. Australia has been carrying out studies for several years to open up mining of significant reserves in the center of the country, the Mount Weld mine namely. Important development projects concern India and Brazil, respectively second and third worldwide producers after China. Important resources have been identified in Canada, Greenland, Norway, Vietnam and even France may have a few reserves in the Cévennes. Author of a recent book on the matter, David Weber, pleads for an ambitious European “Airbus of the Sea” type project in order to open up underwater mining in the French Pacific territories supposedly rich in rare earths. Without forgetting the recycling sector, however marginal it may be.

One thing however is certain. The technological and environmental constraints that China will have to face, as well as the countries wanting to free themselves partially of their dependence on China, are going to weigh heavily on the future prices of rare earths. Our green technologies and electronic gadgets will become increasingly expensive. The solution also inevitably resides in the reduction of demand and in an indispensable reflection on the relevance of an economic model founded on limitless growth in a world where, every day, we discover the finite nature of our natural resources.