Heat Pumps: A Technology for Energy Independence

The rise of heat pumps and how they can help Europe hit its climate goals while weaning itself off Russian gas.

A crucial part of the fight against climate change boils down to how we heat and cool our homes but when it comes to slashing greenhouse gas emissions, Europe’s buildings are way off track. Achieving the European Union’s target of ‘climate neutrality’ by 2050 will require a 60% drop in greenhouse gas emissions from buildings by 2030 compared to 2022. However, with the policies in place, household emissions are projected to decrease by just 11% by 2030. This is mainly due to the over 90 million fossil fuel boilers installed in homes across the EU.

Cleaner heat, cleaner health

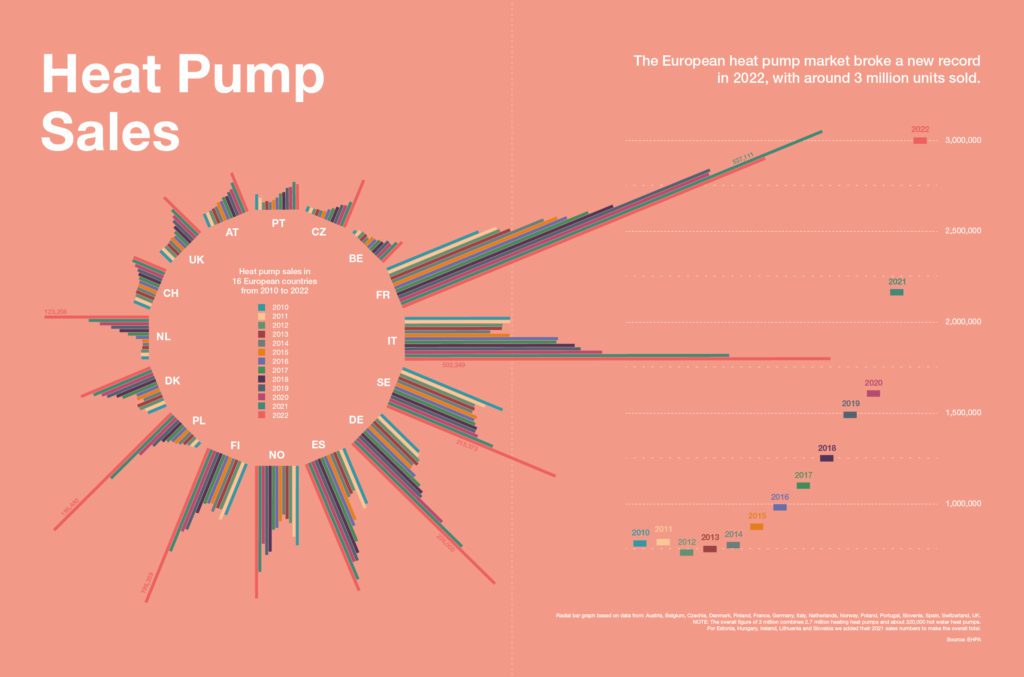

A clean alternative to Europe’s vast stock of gas and oil boilers is the heat pump, which takes a renewable source of energy outdoors – from air or water – and efficiently turns it into heat with only a small amount of additional electricity. Heat pumps can also use waste heat from industrial processes or cooling and turn it into warmth for buildings. Heat pump sales in Europe climbed steadily between 2013-20 and spiked in 2021 and again in 2022.

The record-breaking 38% hike in annual heat pumps sales in 2022, which equates to an estimated 3 million devices according to market data gathered by the European Heat Pump Association (EHPA), came amidst Russia’s invasion of Ukraine and the widespread disruption it sowed on Europe’s energy markets. In response to the energy crisis, the European Commission presented its REPowerEU plan on 18 May 2022, which set out a roadmap on how the bloc would end its reliance on Russian fossils fuels by 2030. Written into the proposal was a bid to add 60 million more heat pumps to the 20 million already installed in the EU by 2030.

Knock-on effects

The European Commission’s heat pump targets would lead to a drop in gas demand from buildings of 40% between 2022 and 2030 and cut CO2 emissions by 46%, an April 2023 study by Cambridge Econometrics calculated. The lower gas demand would shrink Europe’s energy import bills by €60 billion, and household heating bills by 20% by 2030. This would increase a household’s disposable income by an average of 2% or more.

According to the Cambridge Econometrics study, this would also lead to a 2.5% growth in annual Gross Domestic Product (GDP) and create 3 million net additional jobs. Alongside these direct economic benefits of investing in heat pumps are the indirect health benefits they provide, given that they do not produce harmful emissions like burning fossil fuels and biomass. If the REPowerEU ambitions are met, nitrous oxide (NOx) emissions from household heating would also fall by almost 40% by 2030 compared to 2022.

With their many benefits evident, it is no wonder that heat pumps sales are breaking records, but the rollout is simply not fast enough to pull ahead of fossil fuel boilers. A new heat pump is installed about every ten seconds in Europe, but a new fossil boiler is installed every eight seconds.

Unless there is a major shift in direction, Europe will miss its targets and remain trapped in the fossil fuel boiler era for some time to come, with all the negative consequences for health, climate, energy bills and imports that this entails.

EU targets, falling short?

The Commission is aware of the urgency of the situation and has taken several steps to help the sector. Proposed on 16 March 2023, the Commission identified heat pumps as a key net zero European industry in its Net-Zero Industry Act. However, the plan contains little detail in terms of subsector targets or intermediary goals. The Act outlined ambitions to increase the manufacturing capacity of heat pumps to 31 gigawatts (GW) by 2030. This target is far lower than the EHPA foresees.

Even a conservative growth scenario would lead to 47 GW by 2030 – more than 50% higher than the Commission’s targets. This is starting from the estimated 21.95 GW of European-made heat pumps installed in Europe in 2022. The Act also sets a goal for the EU to produce domestically at least 40% of the technology it needs to achieve its climate and energy targets by 2030.

Accelerating the heat pump rollout

Following months of advocacy from the EHPA and its members, the Commission announced it would publish a heat pump action plan before the end of 2023. The plan will include communication outreach to citizens, business and small industries, EU laws to help bring an end to gas boilers – such as the proposal to stop them being put on the market from 2029 – and actions to make financing more accessible.

Part of the action plan is to be an ‘accelerator’ or partnership between the Commission, Member States and the heat pump sector. The EHPA has already been working on this with the European Climate Foundation and a range of EU officials, NGOs, think tanks and heat pump manufacturers to identify barriers and how to address them.

The ‘accelerator’ document will be presented to the Commission in early June 2023. Challenges and actions have been clearly identified by participants.

One of the main hurdles to overcome is cost. Even though a heat pump is around 30% cheaper than a fossil fuel boiler over its lifetime, the upfront costs are much higher in most markets. The affordability of heat pumps could be improved by reducing taxes and levies on heat pumps, device installation and electricity.

Information on heat pumps needs to be better and clearer. Comparing heat pump options, choosing an installer, obtaining approvals and qualifying for relevant subsidies can be complex and time-consuming for customers.

A new heat pump is installed about every ten seconds in Europe, but a new fossil boiler is installed every eight seconds.

There are pools of skilled workers, especially heat pump installers, and demand for such labor will only increase as heat pump sales continue to grow. The EHPA has calculated that REPowerEU’s heat pump rollout targets mean we need a minimum of 500,000 skilled full time equivalent employees by 2030 in Europe, up from around 120,000 today. Countries should be encouraged to introduce financial incentives targeted towards installers.

Another major issue arises in the supply chain, where bottlenecks are adding to manufacturing costs and threatening capacity growth plans worth billions of euros. European production capacity could be increased by developing an EU industrial strategy for heat pumps and heat pump components.

The sector would also benefit from investment in power, power distribution and smart grids given that heat pumps can offer flexibility by using electricity when it is in greater supply and cheaper.

A crucial way of ensuring a smoother path for heat pump growth is through legislation that clearly sets a direction of travel and fosters confidence among investors and manufacturers. In this regard, ending the sale of fossil fuel boilers from 2029 would send a clear message on the way the wind is blowing.

Hurdles ahead

The Commission’s proposal and vote by the European Parliament to speed up the end of fluorinated gases – an essential component for heat pumps – could jeopardize the goals the EU seeks to reach. The heat pump sector has been gradually moving away from F-gases, due to their impact on global warming, and has been replacing them with refrigerants with low global warming potential and non-fluorinated alternatives.

Yet ramping up the timeline for phasing out these gases at the same time as setting ambitious targets for heat pumps under REPowerEU is incompatible. Instead, the EU needs to allow manufacturers and the whole sector time to adapt rather than slow down heat pump growth and force consumers back to fossil fuels.

Overall, the future is bright for the European heat pump sector.

The sector is in a prime position to help citizens move to secure, clean heating which is not impacted by fluctuating and unpredictable energy prices.

But it needs the barriers and risks to growth to be addressed so that we can achieve clean, affordable heating for all, helping to fight climate change and benefitting all European citizens, our health, comfort, and the homes we live in.